Here is an interview with Noam Chomksy posted on ZNet today, which talks about positive developments in Latin America.

The Financial Crisis of 2008

Interviewed by Simone Bruno

October 13, 2008

By Noam Chomsky

I would like to talk about the current crisis. How is it that so many people could see it coming, but the people in charge of governments and economies didn't, or didn't prepare?

The basis for the crisis is predictable and it was in fact predicted. It is built into financial liberalization that there will be frequent and deep crises. In fact, since financial liberalization was instituted about thirty five years ago, there has been a trend of increasing regularity of crises and deeper crises, and the reasons are intrinsic and understood. They have to do fundamentally with well understood inefficiencies of markets. So, for example, if you and I make a transaction, say you sell me a car, we may make a good bargain for ourselves, but we don't take into account the effect on others. If I buy a car from you it increases the use of gas, it increases pollution, it increases congestion, and so on. But we don't count those effects. These are what are called by economists externalities, and are not counted into market calculations.

These externalities can be quite huge. In the case of financial institutions, they are particularly large. The task of a financial institution is to take risks. Now if it is a well managed financial institution, say Goldman Sachs, it will take into account risks to itself, but the crucial phrase here is to itself. It does not take into account systemic risks, risks to the whole system if Goldman Sachs takes a substantial loss. And what that means is that risks are underpriced. There are more risks taken than should be taken in an efficiently working system that was accounting for all the implications. More, this mispricing is simply built into the market system and the liberalization of finance.

The consequences of underpricing risks are that risks become more frequent, and, when there are failures the costs are higher than taken into account. Crises become more frequent and also rise in scale as the scope and range of financial transactions increases. Of course, all this is increased still further by the fanaticism of the market fundamentalists who dismantled the regulatory apparatus and permitted the creation of exotic and opaque financial instruments. It is a kind of irrational fundamentalism because it is clear that weakening regulatory mechanisms in a market system has a built-in risk of disastrous crisis. These are senseless acts except in that they are in the short-term interest of the masters of the economy and of the society. The financial corporations can and did make tremendous short term profits from pursuing extremely risky actions, including especially deregulation, which harm the general economy, but don't harm them, at least in the short term that guides planning.

You couldn't predict the exact moment at which there would be a severe crisis, and you couldn't predict the exact scale of the crisis, but that one would come was obvious. In fact, there have been serious and repeated crises during this period of increasing deregulation. It is just that they hadn't yet hit so hard at the center of wealth and power before, but have instead hit mostly the third world. So, again, the crises are predictable and predicted. There was a book, for example, ten years ago, by two very well respected international economists, John Eatwell and Lance Taylor - Global Finance at Risk - in which they ran through the pretty elementary logic of how financial liberalization underprices risk and therefore leads to regular systemic risks and failures, sometimes serious. They also outline ways of dealing with the problem, but those were ignored because decision makers in the corporate and political systems, which are about the same, were making short term gains for themselves.

Take the United States. It is a rich country, but for the majority of the population, a substantial majority, the last thirty years have probably been among the worst in American economic history. There have been no massive crises, large wars, depressions, etc. But, nevertheless, real wages have pretty much stagnated for the majority for thirty years. In the international economy the effect of financial liberalization has been quite harmful. You read in the press that the last thirty years, the thirty years of neoliberalsm, have shown the greatest escape from poverty in world history and tremendous growth and so on, and there is some truth to that, but what is missing is that the escape from poverty and the growth have taken place in countries which ignored the neoliberal rules. Countries that observed the neoliberal rules have suffered severely. So, there was great growth in East Asia, but they ignored the rules. In Latin America where they observed the rules rigorously, it was a disaster.

Joseph Stiglitz recently wrote in an article that the most recent crisis marks the end of neoliberalism and Chavez in a press conference said the crisis could be the end of capitalism. Which one is closer to the truth, do you think?

First, we should be clear about the fact that capitalism can't end because it never started. The system we live in should be called state capitalism, not just capitalism. So, take the United States. The economy relies very heavily on the state sector. There is a lot of agony now about socialization of the economy, but that is a bad joke. The advanced economy, high technology and so forth, has always relied extensively on the dynamic state sector of the economy. That's true of computers, the internet, aircraft, biotechnology, just about everywhere you look. MIT, where I am speaking to you, is a kind of funnel into which the public pours money and out of it comes the technology of the future which will be handed over to private power for profit. So what you have is a system of socialization of cost and risk and privatization of profit. And that's not just in the financial system. It is the whole advanced economy.

So, for the financial system it will probably turn out pretty much as Stiglitz describes. It is the end of a certain era of financial liberalization driven by market fundamentalism. The Wall Street Journal laments that Wall Street as we have known it is gone with the collapse of the investment banks. And there will be some steps toward regulation. So that's true. But the proposals that are being made, which are major and severe, nonetheless do not change the structure of the underlying basic institutions. There is no threat to state capitalism. Its core institutions will remain basically unchanged and even unshaken. They may rearrange themselves in various ways with some conglomerates taking over others and some even being semi-nationalized in a weak sense, without infringing much on private monopolization of decision making. Still, as things stand now, property relations and the distribution of power and wealth won't alter much though the era of neoliberalism operative for roughly thirty five years will surely be modified in a significant fashion.

Incidentally, no one knows how serious this crisis will become. Every day brings new surprises. Some economists are predicting real catastrophe. Others think that it can be patched together with modest disruption and a recession, likely worse in Europe than in the U.S. But no one knows.

Do you think we will see anything like the depression, with people out of working and cuing up in long lines for food. Do you think it is possible we could have that kind of situation in the U.S. and Europe? Would a big war then get economies back on track, or shock therapy or what?

Well, I don't think the situation is anything like the period of the great depression. There are some similarities to that era, yes. The 1920s were also a period of wild speculation and vast expansion of credit and borrowing, creating of tremendous concentration of wealth in a very small sector of the population, destruction of the labor movement. These are all similarities to today. But there are also many differences. There is a much more stable apparatus of control and regulation growing out of the New Deal and though it has been eroded, much of it is still there. And also by now there is an understanding that the kinds of policies that seemed extremely radical in the New Deal period are more or less normal. So, for example, yesterday in the presidential debate, John McCain, the right-wing candidate, proposed New Deal style measures to deal with the housing crisis, borrowed straight from the New Deal Homeowners Refinancing Act, though actually McCain borrowed it from Hilary Clinton who took it from the New Deal. That's the far right. So there is an understanding that the government must take a major role in running the economy and they have experience with doing it for the advanced sectors of the economy for fifty years.

A lot of what you read about this is just mythology. So, for example, you read that that Reagan's passionate belief in the miracle of markets is now under attack, Reagan being assigned the role of High Priest of faith in markets. In fact, Reagan was the most protectionist president in postwar American economic history. He increased protectionist barriers more than his predecessors combined. He called on the Pentagon to develop projects to train backward American managers in advanced Japanese methods of production. He carried out one of the biggest bank bailouts in American history, and formed a government-based conglomerate to try to revitalize the semiconductor industry. In fact, he was a believer in big government, intervening radically in the economy. By "Reagan" I mean his administration; what he believed about all of this, if anything, we don't really know, and it's not very important.

There is a tremendous amount of mythology to be dismantled here, including the talk about the great growth and escape from poverty which, as I said earlier, isn't false, but is missing the fact that it took place overwhelmingly in areas that ignored the neoliberal rules, while the areas that kept to the rules are the ones that suffered. The same holds in the U.S. To the extent that the neoliberal rules were applied, it was quite harmful to the majority of the population. So to talk about these matters, we first have to sweep away a lot of mythology and then, when we look, we see that a state capitalist economy that has, particularly since the Second World War, relied very heavily on the state sector, is now returning to reliance on the state sector to manage the collapsing financial system, its collapse being the predictable result of financial liberalization. The underlying institutional structure itself is being modified, but not in fundamental ways.

There is no indication right now that there will be anything like the crash of 1929.

So you don't think we are going toward a change of the world order?

Oh there are changes in world order, very significant ones and maybe this crisis will contribute to them. But they have been underway for some time. One of the greatest changes in world order you can see right now in Latin America. It is called the backyard of the United States and it's been supposed to be run by the U.S. for a long time. But that is changing. Just a few weeks ago, mid September, there was a very dramatic illustration of this. There was a meeting on September 15 of UNASUR, The Union of South American Republics, so that's all the South American governments meeting, including Colombia, the U.S.'s favorite. It took place in Santiago, Chile, another U.S. favorite. The meeting came out with a very strong declaration supporting Evo Morales in Bolivia and opposing the quasi-secessionist elements in Bolivia that are being supported by the United States.

There is a major struggle going on in Bolivia. The indigenous majority of the population for the first time in 500 years entered the political arena, carried through a very impressive democratic election, and took power. That of course horrified the United States government, which is strongly opposed to popular democracy unless it comes out the right way. And it particularly antagonized the traditional ruling groups, the minority elite which is mostly white and Europeanized, who had always run the country and of course don't want a democratic society in which control of resources and policy generally will be directed by the majority and towards its needs. So the elites are moving toward autonomy and maybe secession, and it is becoming quite violent, with the U.S. of course backing them. But the South American Republics took a strong stand in support of the indigenous-dominated democratic government. The statement was read by President Bachelet of Chile, who is a favorite of the West. Evo Morales responded by thanking the presidents for their support, while correctly pointing out that this was the first time in 500 years that Latin America had taken its fate into its own hands without the interference of Europe and particularly the United States. Well, that is a symbol of a very significant change that is underway, sometimes called the pink tide. It was so important that the U.S. press wouldn't report it. There is a sentence here and there in the press noting that something happened, but they are completely suppressing the content and significance of what happened.

Now that is part of a long term development in which South America is indeed beginning to overcome its tremendous internal problems and also its subordination to the West, for the most part, the United States. South America is also diversifying its relations with the world. Brazil has growing relations with South Africa and India, and particularly China, which is increasingly involved in investments and exchange with Latin American countries. These are extremely important developments and now it is beginning to spread to Central America. Honduras, for example, is the classic banana republic. It was the base camp for Reagan's terror wars perpetrated in the region and has been totally subordinated to the U.S. But Honduras recently joined ALBA, the Venezuelan-based "Bolivarian alternative." It is a small step, but nonetheless very significant.

Do you think these trends in South America like ALBA, UNASUR and the major events in Venezuela and Bolivia and the rest might be affected by an economic crisis of the dimension we are facing now?

Well, they will be affected by the crisis, but for the moment they are not as much affected as Europe and the United States. So, if you look at the stock market in Brazil, it collapsed very quickly, but Brazilian banks aren't failing. Similarly, in Asia the stock markets are declining sharply, but the banks are not being taken over by the government as is happening in England and the U.S. and much of Europe. These regions, South America and Asia, have been somewhat insulated from the ravages of the financial markets. What set off the current crisis was the subprime lending for assets built on sand, and these are held, of course in the United States, but apparently about half by European banks. Holding mortgage-based toxic assets has embroiled them in these events very quickly -- and they have housing crises of their own, particularly Britain and Spain. Asia and Latin America were much less exposed, having kept to much more cautious lending strategies, particularly since the neoliberal meltdown of 1997-8. In fact, a main Japanese bank, Mitsubishi UFG, has just bought a substantial part of Morgan Stanley, in the U.S. So it doesn't look, so far, as though Asia or Latin America will be affected nearly as severely as the U.S. and Europe.

Do you think there will be a big difference between Obama or McCain as President for things like the Free Trade Agreement and Plan Colombia, because here in Colombia, where I live, you can feel that the President and the establishment are kind of scared about an election of Obama. I know you feel Obama is like a blank slate, but still, do you feel there is a difference?

That's pretty much the case. Obama has presented himself as pretty much a blank slate. But there is no reason for the Colombian establishment to be scared of his election. Plan Colombia is Clinton's policy and there is every reason to expect that Obama will be another Clinton. He is pretty vague. He keeps appearances mostly empty, on purpose, but insofar as there are policies they look very much like centrist policies, like Clinton's, who fashioned Plan Colombia and militarized the conflict, and so on.

Sometimes I have the feeling that the two terms of Bush were in a context of the changing of the global order, trying to maintain power using force and in contrast Obama could be a way to have a kind and polite face to renegotiate the world order. Do you think this could be true?

Remember that the political spectrum in the United States is quite narrow. The U.S. is a business-run society, somewhat more than Europe. Basically, it is a one-party state, with a business party that has two factions, Democrats and Republicans. The factions are somewhat different, and sometimes the differences are significant. But the spectrum is quite narrow. The Bush administration, however, was way off the end of the spectrum, extreme radical nationalists, extreme believers in state power, in violence overseas, in big government spending, so far off the spectrum that they were harshly criticized right within the mainstream from early on.

Whoever comes into office is likely to move things back more towards the center of the spectrum, Obama probably more so. So I would expect in Obama's case something like a revival of the Clinton years, of course adapted to changing circumstances. In the case of McCain, however, it is quite hard to predict. He is a loose cannon. Nobody knows what he would do...

Yes he seems quite dangerous.

Very dangerous, especially in a country like the U.S. with so much power. This isn't Luxemburg, after all. McCain himself is extremely unpredictable. The vice Presidential candidate, Sarah Palin, comes from a radical extremist background (by world standards), for example creationism - you know, the world was created 10,000 years ago, etc. etc. If someone like that was running for high office in Luxemburg it would be comical. But when it happens in the richest and most powerful country in the world, it is dangerous.

Now that we are at the end of neoliberal globalization, is there a possibility of something really new, a good globalization?

I think the prospects are much better than they have been. Power is still incredibly concentrated, but there are changes with the international economy becoming more diverse and complex. The South is becoming more independent. But if you look at the U.S., even with all the damage Bush has done, it is still the biggest homogeneous economy, with the largest internal market, the strongest and technologically most advanced military force, with annual expenses comparable to the rest of the world combined, and an archipelago of military bases throughout the world. These are sources of continuity even though the neoliberal order is eroding both within the U.S. and Europe and internationally, as there is more and more opposition to it. So there are opportunities for real change, but how far they will go depends on people, what we are willing to undertake.

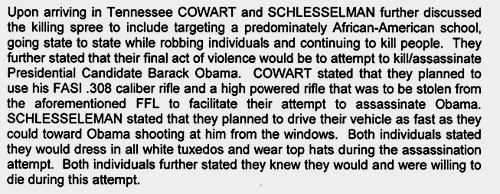

The assassination was to be the culmination of a “killing spree” that would also single out children at an unnamed, predominately black school, federal officials said. The men talked of “killing 88 people and beheading 14 African-Americans,” according to the affidavit.